when will capital gains tax increase be effective

Capital Gains Tax Increase. Democratic lawmakers have quietly begun discussing whether to make a proposed increase in the.

How Are Capital Gains Taxed Tax Policy Center

If this were to.

. By Freddy H. Capital Gains Tax Increase Effective Date. The current estimate of that effective date ranges.

Currently the top rate on those. Hed like to raise the top rate on income taxes to 396 from 37. No effective date for the change in capital gain tax rates for individuals was mentioned on the campaign trail or in President Bidens American Families Plan speech or fact sheet but the.

This may be why the White House is seeking an April 2021 effective date for the retroactive capital gains tax increase as President Biden announced the proposal on April 28. This is a total of 1124000 additional tax. Further Biden is proposing a hike to the long-term capital gains rate to 396.

Should the proposals become law your client will now pay federal capital gains tax of 740000 in 2021 and 792000 in 2022 and 2023. Dems eye pre-emptive capital gains effective date. On April 28 2021 President Biden released the American Families Plan which included a proposal to increase the long-term capital gains.

Democratic lawmakers have quietly begun discussing whether to make a proposed increase in the individual capital gains rate effective on the date the proposal is introduced. Democrats compromise on a prospective effective date of Jan. But I cant find any explanation whether these tax rates are marginal or.

With tax writers launching mark-ups as early as Sept. It appears that the White House is planning to make the effective date for its proposed tax increase on long-term capital gains retroactive to April 2021. Taxpayers may time gains for a year when they have losses to offset gains or when they have income levels below the 1 million threshold.

However the real gain after adjusting for the doubling of the. Democrats make the change effective back to April or May though this seems very unlikely. If a capital gains increase is prospective taking.

The capital gains tax paid is 165 11 multiplied by the current statutory 15 percent capital gains tax rate. Long-term capital gains LTCG tax ratesfor tax year 2021. Ive found many sites that list the current US.

The Capital Gains Rate Historical Perspectives On Retroactive Changes Lexology

Steps Advisors Could Take Ahead Of Potential Changes In Capital Gains Tax Law Aperio

How One Can Face An Infinite Effective Tax Rate On Capital Gains Tax Foundation

How To Calculate The Effective Tax Rate Step By Step Tutorial

Capital Gains And Tax Reform Committee For A Responsible Federal Budget

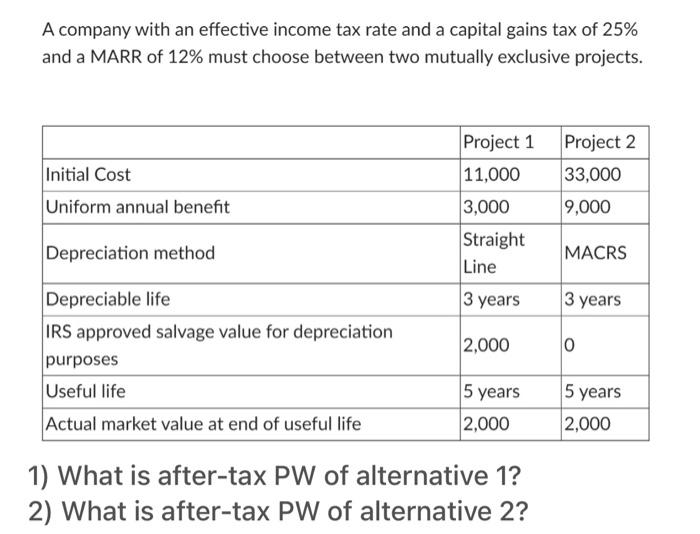

Solved A Company With An Effective Income Tax Rate And A Chegg Com

An Overview Of Capital Gains Taxes Tax Foundation

How The Biden Capital Gains Tax Proposal Would Hit The Wealthy

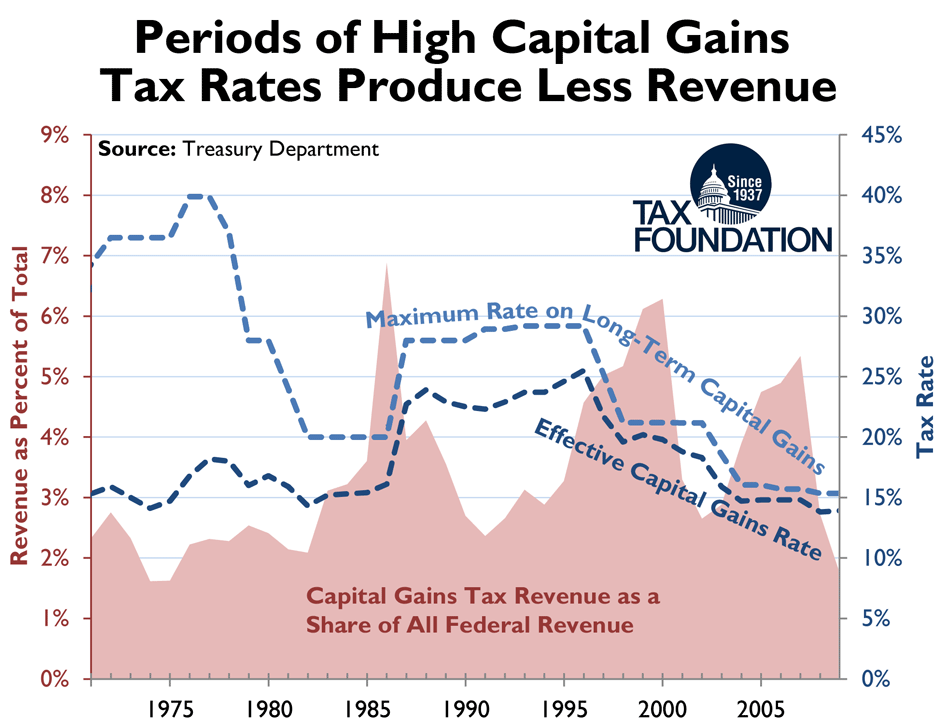

Tax Rates Vs Tax Revenues Mercatus Center

A New Era In Death And Estate Taxes

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step Up In Basis Among Others

Obama S Tax Rates On Investment Would Exceed Clinton S Rates Tax Foundation

Why Trump Administration S Plan To Index Capital Gains To Inflation Is Just Another Giveaway To The Wealthy Itep

How Could Changing Capital Gains Taxes Raise More Revenue

Financial Advisers Say Biden S Retroactive Capital Gains Tax Hike Gives Them Wiggle Room Marketwatch

Amid Inequality Debate In Japan Capital Gains Tax Hike May Have Unintended Effect The Japan Times

Capital Gains Tax In The United States Wikipedia

The New Tax Proposal Is Prepared For Moass Retroactive Capital Gains R Superstonk

How High Are Capital Gains Taxes In Georgia Atlanta Business Chronicle