nj property tax relief check

Requests for special and supplemental relief must be received in the state office on or before december 1st in order to be acted on for the 2022 year. All relief approvedgranted during 2022 must be paid out by 12312022.

Real Estate Taxes Vs Property Taxes Quicken Loans

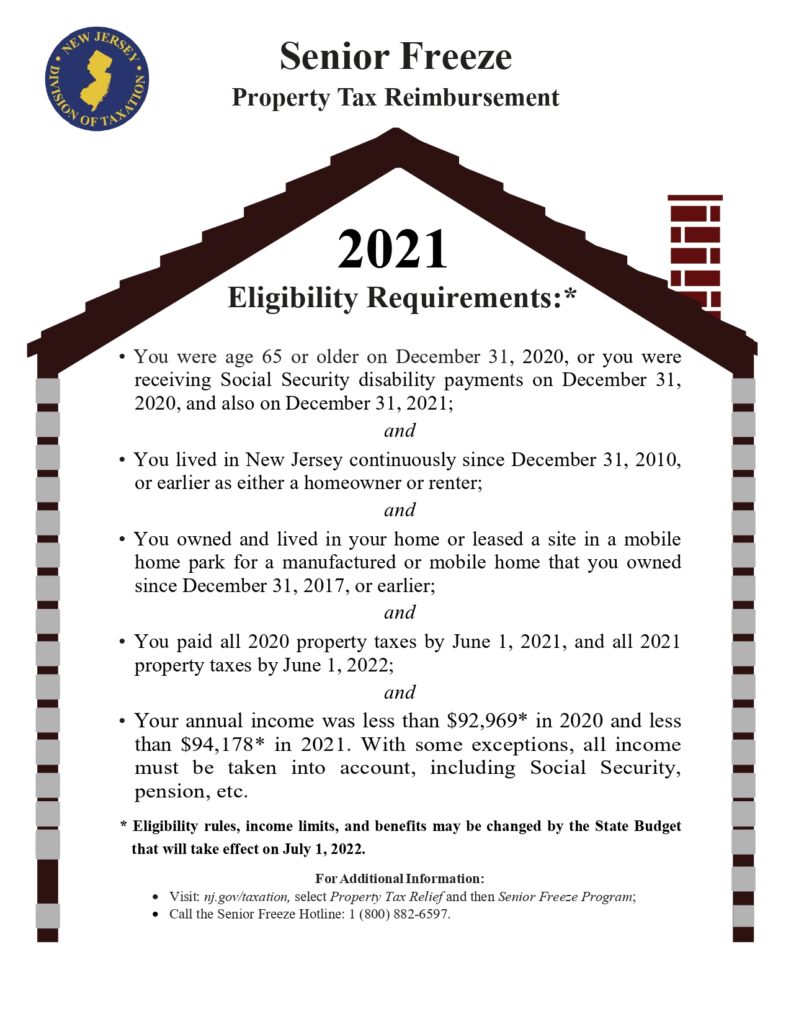

You can still file for the 2021 Senior Freeze.

. If this is your first time filing a tax return with New Jersey you cannot use this portal to make a payment. With up to 1500 in property tax rebates available to homeowners and 450 for renters we prioritized tax relief for two million households to get money back in their pocket said Assembly. Property taxes are billed once a year in either late July or early August and contain 4 quarterly tax payment coupons.

Make sure you review your tax card and look at comparable homes. New Jersey Property Tax Relief Programs. Go here if you want to pay other taxes online.

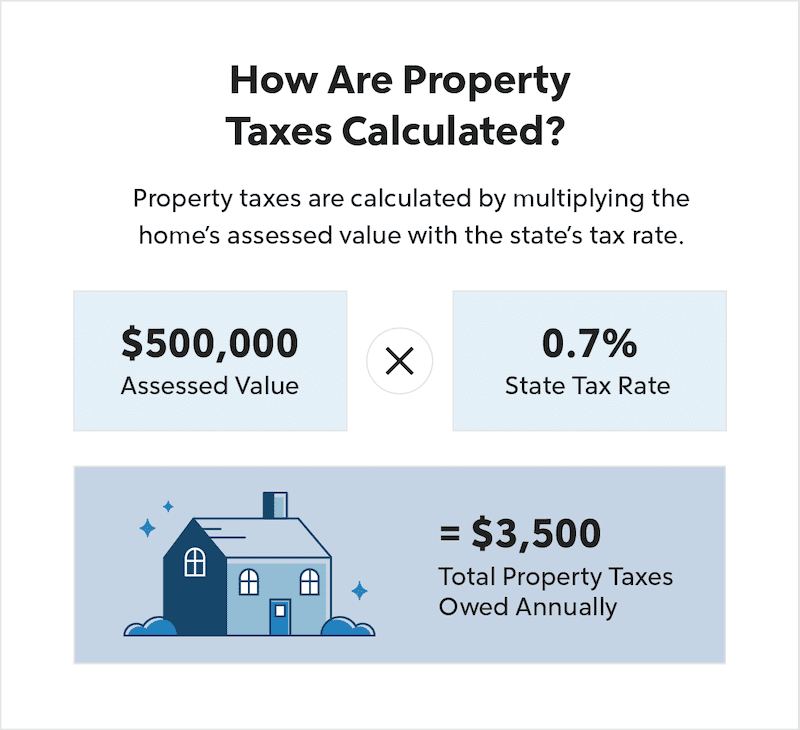

Property taxes are calculated by multiplying your municipalitys effective tax rate by the most recent assessment of your property. Feb1 May 1 Aug. There is no carryover of approvals or granted amounts to 2023.

Property tax reimbursement senior freeze To check status of a filed application. Treasury Announces NJ Division of Taxation Extends Filing Payment Deadlines for Tropical Storm Ida Victims. For a middle-class family receiving the 1500 in direct relief the average bill will effectively become 7800 a property tax level New Jersey has not seen since 2012 the administration.

This page is for Income Tax payments filings and inquiries - as well as for repayments of excess property tax relief benefits Senior Freeze or Homestead BenefitIt cannot be used to make Inheritance or Estate Tax payments. Additional duties include maintaining property transfers keeping current ownership updated checking building permits that have been issued and maintaining current values. New Jerseyans who qualify can soon file online via this link.

Eligible homeowners and rents will be able to apply either online by phone or via mail similar to the Homestead Rebates process. We have also temporarily activated 877-829-2866 for taxpayers who prefer to file by phone. As an alternative taxpayers can file their returns online.

All property tax relief program information provided here is based on current law and is subject to change. The Affordable New Jersey Communities for Homeowners and Renters ANCHOR program replaces the Homestead Benefit for the 2019 tax year. TB-98R Federal Return and the Forms and Schedules to Include with the Corporation Business Tax Return Pursuant to PL.

The deadline for 2021 applications is October 31. Submit a check made payable to Greenwich Township for the correct amount with. NJ Tax Relief for Hurricane Ida Victims.

The 3rd quarter 2022 relief paid report is due by october 30th. The Business Tax telephone filing system is experiencing issues with the 609-341-4800 filing number. The filing deadline for the 2018 Homestead Benefit was November 30 2021.

The State of New Jersey provides information regarding the following programs at their website or by calling the following numbers. The main function of the Tax Assessors Office is the appraisal and evaluation of all land and buildings within the municipality for tax purposes according to state statutes. Property Tax Relief Programs.

2021 Senior Freeze Applications. You may contact the Gloucester County Board of Taxation located at 1200 N Delsea Drive Bldg A Clayton NJ 856-307-6448 or visit the county website wwwgloucestercountynjgov Departments B for Board of Taxation Forms A1 Appeals. By resolution Moorestown permits a 10 day grace period.

Property tax relief HERE.

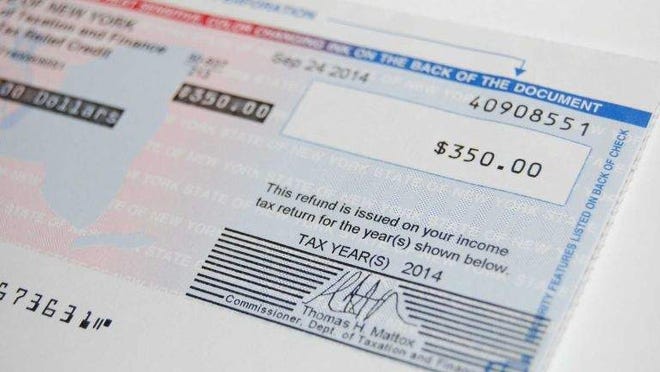

New York Property Owners Getting Rebate Checks Months Early

Tuesday February 18 2014 Financial Institutions To Mail Out Form 1099 B Relating To Sales Of Stock Bonds Or Mutual Tax Forms Tax Preparation List Of Jobs

The Official Website Of City Of Bayonne Nj Tax Collection

How To Fill Out A W 4 A Complete Guide Tax Mistakes Tax Debt Income Tax Return

Tax Assessor Township Of Franklin Nj

State Local Property Tax Collections Per Capita Tax Foundation

Murphy Announces Details Of Property Tax Relief Program Whyy

Nj Property Tax Relief Program Updates Access Wealth

2022 Property Taxes By State Report Propertyshark

2021 Senior Freeze Application Information Township Of North Brunswick

Gov Phil Murphy Announces Expansion Of Anchor Property Tax Relief In New Jersey Cbs New York

Earn Union Property Tax Credit By Shopping Local Union Nj News Tapinto

Pin On Real Estate Investing Tips

Property Tax By State Ranking The Lowest To Highest

Cypress Texas Property Taxes What You Need To Know Property Tax Tax Attorney Tax Lawyer

Ny Ended The Property Tax Relief Checks Why They May Not Come Back